Income Tax Return Filing In Mumbai | ITR Filing Services

- Same day filling

- Anywhere

- At a Single Click

Connect with our experts

Update![]() : On 27th May 2025, the CBDT extended the due date for filing Income Tax Returns for the Financial Year 2024–25 (Assessment Year 2025–26) from the original deadline of 31st July 2025 to 15th September 2025

: On 27th May 2025, the CBDT extended the due date for filing Income Tax Returns for the Financial Year 2024–25 (Assessment Year 2025–26) from the original deadline of 31st July 2025 to 15th September 2025

Income Tax Filing

Income Tax Return (ITR) is a declaration of your total income earned during a financial year i.e April to March. It is submitted electronically filling Forms available on governments official portal. In this article we’ll be guiding you the procedure for the same.

It ensures revenue collection for nation-building and governance for the government, and provides legal compliance, access to refunds, and proof of income for financial and legal purposes for taxpayers.

Practically, all individuals whether salaried employees, freelancers, business owners, or other individual earning more than ₹3 lakhs in Financial Year 2024–25 (as per the new regim) are required to file their Income Tax Returns. In addition, all entities such as Partnership Firms, Private Limited Companies, LLPs, Societies, and Trusts (NGOs) are mandatorily required to file their returns, regardless of turnover. This means that even if there was no business activity during the year, return filing is still compulsory for non individuals.

Practically, all individuals whether salaried employees, freelancers, business owners, or other individual earning more than ₹3 lakhs in Financial Year 2024–25 (as per the new regim) are required to file their Income Tax Returns. In addition, all entities such as Partnership Firms, Private Limited Companies, LLPs, Societies, and Trusts (NGOs) are mandatorily required to file their returns, regardless of turnover. This means that even if there was no business activity during the year, return filing is still compulsory for non individuals.

Certain high-value financial transactions and conditions make it mandatory to file an Income Tax Return (ITR), even if your income is below the basic exemption limit. As per Rule 12AB of the Income Tax Rules and Section 139(1) of the Income Tax Act, ITR filing becomes compulsory if any of the following conditions are met:

Conditions That Make ITR Filing Mandatory:

1. Total income exceeds the basic exemption limit

₹2.5 lakh (below age 60)

₹3 lakh (age 60–80)

₹5 lakh (above 80)

2. Aggregate deposits of ₹1 crore or more in one or more current accounts in a financial year.

3. Spending more than ₹2 lakh on foreign travel for yourself or any other person.

4. Spending more than ₹1 lakh on electricity bills in a financial year.

5. Total sales, turnover, or gross receipts from business exceed ₹60 lakh, or from profession exceed ₹10 lakh during the financial year.

6. TDS or TCS of ₹25,000 or more (₹50,000 for senior citizens) has been deducted or collected in the financial year.

7. Payment of ₹10 lakh or more via credit card in a financial year.

Additionally, if you are eligible for a refund, filing an Income Tax Return is mandatory to claim it.

We also advise all small freelancers with a turnover exceeding ₹10 lakhs, and traders with turnover crossing ₹20 lakhs, to file their returns to ensure compliance and avoid future tax scrutiny.

“The more openly you speak to a doctor, the better they can treat you the same goes for your CA. Full disclosure helps us serve you best and keep you compliant.”

The common document for all type of tax payers are IT portal Credentials or PAN Card, Aadhar Card and Bank Statements. As per the following List detail and specific documents are reuired:

The Due date to submit the return online is 31st July 2025. For Audit case The due date is 31st October and for Transfer pricing Taxpayers it is 30th November. Taxpayers must not wait for the last moment as the income tax portal may not give timely response.

Late filing consequences

Late fees for late filing is Rs.5000 u/s234F of Income Tax Act 1961 . However, for small taxpayer who’s total income is not more than 5 lakh, maximum penalty will be Rs. 1000 under the said section. Moreover, Interest under Sections 234A, 234B, and 234C at 1% per month or part thereof on the unpaid tax amount under each section. There is another very important date, that is 31st December 2025 which is the last date to file ITR with late fees and interest. After 31st December taxpayer can not apply for refund.

Following are the benefits of Timely filing of Income tax returns:

• Timely filing of your Income Tax Return (ITR) is essential to claim any eligible refund of Tax Deducted at Source (TDS).

• Filing your ITR before the due date allows you to carry forward business losses and capital losses (such as those from share trading) to offset them against future profits.

• Income Tax Return documents serve as valid proof of income and reflect your financial standing, which can be useful for various financial and official purposes.

• ITR filings are often required during visa application processes, as they provide a reliable record of your income and tax compliance.

• High-value financial transactions may attract scrutiny from government authorities. Proper disclosure of income through timely ITR filing significantly reduces the likelihood of receiving such inquiries or summons.

Table of Contents

Compliances

Income Tax Return Filing in Mumbai- An Overview

Know your residential status income

Why Residential Status is Important

Every year all the taxpayers need to determine their residential status before income tax return filing in mumbai. Ascertaining the residential status becomes crucial because the incidence of tax depends on the residential status of the Taxpayers.

The same income may become not taxable for some taxpayers if their residential status changed for a particular year. In India, all the Income earned or accrued or arising from India is taxable to all persons irrespective of their residential status.

Condition for Residential Status

The general condition for an individual to become a resident for the purpose of Income-tax is if his stay in India for a particular Financial year is 182 days or more. Other than this, if the stay is less than 182 days but at least 60 days and for 4 years before that financial year his total stay was 365 days or more than he still is a resident.

The 60 days condition won’t apply to an individual who is an Indian citizen and leaves India for employment or a person of Indian origin who comes on a visit to India.

To determine the residential status of taxpayers other than individuals, we have to check whether business is wholly or partly managed in India. In that case the business will be considered Resident. For a Private Limed Company, it is always Resident if registered in India.

Compute Total Income From All The Sources

Income Taxable in India:

For the purpose of Income-tax all the possible sources through which one can earn are taken by the Income tax Act 1961. Income from salary, Profits of the business, Rental Income, Interest Income, Gain on sale of Property, lottery, etc. are taxable under Income tax. Taxpayers are required to accumulate all his income from all sources in order to compute the correct amount of Income-tax.

Exempt Income:

Exempt Income is the income that is not chargeable to Income tax in India. Under Income Tax Act 1961, Agriculture Income is exempt. Income from some approved provident funds, House rent allowance, Profit on sale of personal assets(other than jewelry) are some of the examples of Exempt Income.

Give Effect of Deductions From the Total Income

What are the Deductions Under Income Tax Act 1961?

In order to save the tax for specific taxpayers and to promote a class of business/region government has allowed some deductions from the income. Income tax Deductions reduce the income and tax liability of the taxpayers.

Section 80C is the famous Deductions taken by small/Individual taxpayers which almost reduces the amount of Income by Rs.1,50,000/-. Other than individuals, corporate taxpayers also get deduction under Income tax on fulfillment of certain conditions.

Compute Your Tax Liability

After computing Total Taxable Income by giving effects to the deductions and exemptions, applicable tax rates are applied on the total income.

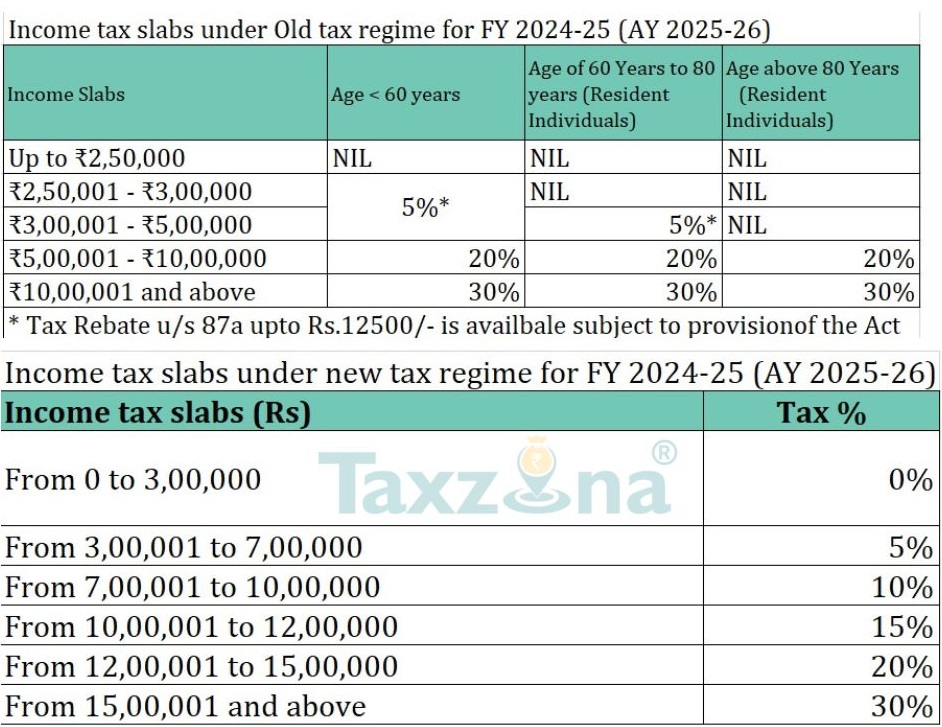

What are the Income Tax Rates?

The average tax rate in India is 30%. However for taxpayers having less income are taxed on slab basis. The below slab rates are for the Individual Taxpayers.

Tax rates for Firms, OPC Compliances and Private Limited company is 30%. The tax rate is 25% for private Limited companies with turnover less than 400 crores in FY 2018-19.

- In India, 4% Health & education cess is charged on the amount of Income Tax in all cases as additional Income tax.

- Apart from this Taxpayers with higher Income has to pay a surcharge on Tax at the following rates.

Pay Your Income Tax Liability in Advance

If the Total Income tax for a year Exceeds Rs. 10,000/-, taxpayer needs to pay this in to advance in four installment throughout the year in which this income is earned. following are the due dates for Advance Income tax Payment:

15th June (15 % of total Tax)

15th Sept. (45% of total Tax)

15th Dec. (75% of total Tax)

15th March (100% of total Tax)

The taxpayers who file their income under presumptive tax scheme, need to pay advance tax on or before 15th March every year.

Salaried Individual’s advance tax is paid by the employer in the Form of TDS, hence they are required to pay Advance tax only for the income other than Salary. They are also required to report their other to the employer so that sufficient Tax is deducted from the salary as per slab rate to avail Interest on short payment of Advance Tax.

Prepare And Submit Your Income Tax Return Return

When you are ready with all the workings you need to file your return. You can take the service from an expert like taxzona for asertainment of your correct income and tax and to submit your return online. However, you can do it by your own by the following steps:

An Income Tax Return filing in Mumbai (ITR) is a form used to file your income and tax information to the Income Tax Department. A taxpayer’s tax liability is determined by his or her income. If the return indicates that a person paid too much tax during the year, the individual may be eligible for an income tax refund from the Income Tax Department.

According to income tax laws, an individual or corporation that generates any income during a financial year is required to submit a return. The income may be received from a salary, business earnings, or rental property, or it may be earned from dividends, capital gains, interest, or other sources.

Every citizen must file an income tax return filing in Mumbai. The IT department validates these income declarations and returns any overpayments to the bank account. To avoid penalties, all enterprises must submit taxes on time.

For Business Income Tax Return Filing:

Income Tax Return Filing in Mumbai: The Indian IT Department requires all companies to submit annual taxes. To guarantee compliance with IT laws and regulations, TDS returns will be submitted and advance taxes paid.

Proprietorship Income Tax Return Filing in Mumbai:

A sole proprietorship is managed by one individual. The proprietor (Business owner) and the business are into the same legal entity. As a summary, proprietorship income tax return filing in Mumbai is the same as the proprietor’s.

Year after year, proprietors must submit IT returns. The process is very similar to submit an individual tax return.

Partnership Firm Income Tax Return Filing in Mumbai:

The Income Tax Act 1961 treats all partnership businesses as distinct legal entities, subject to the same tax rates as LLPs and Indian corporations.

Who should file Income Tax Return Filing in Mumbai?

If total income during the financial year exceeds the basic exemption limit, ITR must be filed by every single person defined per the Income Tax Act 1961. There are seven-person defined u/s 2(31) of the Income Tax Act 1961 are as follows:

- An Individual,

- A Hindu undivided family,

- A Company,

- A Firm,

- Association of persons or a body of individual, whether incorporated or not,

- A local authority, and

- Any artificial juridical person that does not come under one of the previous sub-clauses.

Head of Income for Income Tax Return Filing in Mumbai

Income from Salary

If the relationship between payer and payee is employer and Employee, that income falls under head of salary. Your company will deduct TDS according to your income range and pay it to the Income tax return filing department. The total income is taxed under this heading once the entire amount of income is computed. TDS will be deducted from any payments, pensions, annuities, commissions, fees, leave encashment, and profits you get from your employer, in addition to your basic salary.

Income from House Property

The next section covers Income from house & Property. Income from house property is likely the only kind of income tax return filing that is taxed on a notional basis. This tax does not just apply to income from the rental of residential property; it also applies to income from the rental of commercial and other kinds of property.

Various deductions are also permitted under this item of income, including the Standard Deduction, the Deduction for Municipal Taxes Paid, and the Deduction for Interest on Home Loans. Rent income is subject to a 10% TDS deduction if it exceeds the stipulated limit.

Profits and Gains from Business or Profession

An income which arise from any kind of business like trade, manufacture, commerce, or profession is chargeable under Profit and Gains from business or profession. An income tax return filing to be charged under this head, there are some rules and conditions that must be fulfilled according to the section 28 of the Income tax act.

Capital Gains or Loss

Income from capital assets, whether movable or immovable, is taxed under the capital gains category. When you sell a capital asset for more than you bought for it, this is referred to as a capital gain. Capital assets include stocks, bonds, precious metals, jewellery, and real estate. It is divided into two sections. Capital gain or loss on a short-term basis and capital gain or loss on a long-term basis.

A short-term capital gain results from the sale of property like House property, building and land owned for one year or less while in case of debt-oriented funds, jewellery should be owned for less than 36 months .Short term capital gain is charged @ 15 %.

In case individuals own an asset for a duration of more than 36 or 24 months, the asset is a long term capital asset. Debt-oriented mutual funds, jewellery, etc., that are held for a duration of more than 36 months and for sale of property like House property, building and land owned for more than year, will come under this category.

Income from Other Sources

Any income that is not taxable under one of the other four categories of income will be taxed under this head of income. This category includes income such as savings bank interest, interest on deposits, and interest on IT refunds, among others.

Penalty for Late Filing u/s 234F

Late fees for income tax return filling in Mumbai is of Rs 10000 u/s234F of Income Tax Act 1961 . However, for small taxpayer who’s total income not more than 5 lakh, maximum penalty will be Rs. 1000.

In other words, If the returns are not submitted by the due date, the taxpayer faces hefty fines. In addition to fines, non-filing of taxes may result in other difficulties and penalties. Late filing of income tax return filing in mumbai fines range from Rs.1,000 to Rs.10,000.

Income tax return filling in Mumbai must be handled by a qualified professional who can provide effective advice in any condition and under any circumstance. Taxzona is a leading income tax return filing in Mumbai. Taxzona with the help of our team of experts efficiently takes care of Income Tax return filing in Mumbai very efficiently and professionally.

The prices quoted above for Income Tax return filling in Mumbai includes Preparation of financial statements, Income Computation, and online filing of Income Tax return. These charges are applicable only for Income Tax returns and are subject to the nature of Income.

Know All About Due Dates of Income Tax Return Filing 2022-2023

Do you have any questions Related to Income Tax Return Filing in Mumbai?

Answers to All Your Questions! If you have any further questions, please do not hesitate to contact us.

About Taxzona

We are a Team of Expert CA, CS, Lawyers & Professional Accountants with the objective to meet the Compliances requirement of the Businessman. We provide end-to-end Consultancy, Registration, advisory and Compliances Consultancy to our Clients.

To know more, reach us at taxzona@gmail.com or call on +91 982044 4477

It is a specified form that allows a person to provide the Income Tax Department with information about his or her income generated (Income Tax Return Filing in Mumbai) through various sources of income as well as taxes paid for the relevant financial year.

ITR filing is the procedure of reporting a taxpayer’s entire income for the year. (Income tax return filing in Mumbai) as Individuals may file their taxes via the IRS official site. Forms ITR 1, 2, 3, 4, 5, 6, and 7 have been notified.

Income tax return filing in Mumbai forms do not require any documentation, such as proof of investment or TDS certificates, whether they are filed manually or online. These records, on the other hand, should be kept by the taxpayer and brought before the tax authorities when requested in scenarios such as assessment, inquiry, and so on.

For the Assessment Year 2020-21, every taxpayer has to file Income tax return filing in Mumbai and all over India electronically except a super senior citizen (whose age is 80 years or above during the previous year 2019-20) who furnishes the return either in ITR-1 or ITR-4.

Individuals/HUFs are required to furnish details of assets and liabilities at year-end only when their taxable income exceeds Rs 50 lakh. The Schedule AL, wherein the details of assets and liabilities are to be furnished, is available only in ITR-2 and ITR-3. Thus, the individual or a HUF who has to report the details of assets and liabilities has to opt for income tax return filing in Mumbai in ITR-2 or ITR-3.

Once you have filed your income tax return Filing in Mumbai, the excess funds will be deposited to your bank account or sent to you by check as soon as the refund has been processed and authorised.

Income return filing in Mumbai must be filled. How to download ITR forms from the Income Tax Department’s website?

Step 1: Go to https://www.incometaxindia.gov.in/

Step 2: From the main page navigation bar, choose ‘Forms/Downloads’ and then ‘Income Tax Returns’.

Step 3: A new page will open with a list of all ITR forms. To download the forms, choose ‘PDF’ next to their names.

About Taxzona

We are a Team of Expert CA, CS, Lawyers & Professional Accountants with the objective to meet the Compliances requirement of the Businessman. We provide end-to-end Consultancy, Registration, advisory and Compliances Consultancy to our Clients.

To know more, reach us at taxzona@gmail.com or call on +91 982044 4477

Income Tax Return Filing Fees

Best Alternatives You Get

ESSENTIAL

-

Income Tax Filing of 1 Year of Salaried Individual

ENHANCED

-

Income Tax Return Filling For Business/Freelancer Without Balance Sheet

ULTIMATE

-

Income Tax Return Filling For Business/Freelancer with Balance Sheet

Client Testimonials

Great experience. Helped me incorporate my company at an affordable price. Also provided good customer support in all stages and clarified all of my queries. Thank you Taxzona Consultancy for your service.

I found Taxzona company through Facebook ads. It was a new experience for me to get my company registered. They are really helpful and very amazing to get all your registration and compliances.

Very professional services. Quality service at its best. Would highly recommend. Try it to believe it that such service do exist in today’s world.

Best Accounting, taxation and management service provider. The quality of services, effectiveness and efficiency are extremely professional. Employee friendly culture, everyone will loved to work with.

Very competent and trustworthy.. Every step of business registration.

Service was good, We got our income tax filing done.