The most awaited upgrade announced by The Central Board of Direct Taxes has now been enabled on Income Tax Portal. Now the taxpayers can deposit their Income Tax by UPI (Unified Payments Interface), RTGS/NEFT and Credit Card. Earlier, there was three payment methods which were available Net Banking, Debit Card and Over the Counter of bank through Challan. Currently, this new payment facility is available on Income tax Portal only and the same has not yet enabled on NSDL website.

UPI operations were started in 2016 in India. It was expected to add UPI payment option with the launch of new Income Tax Portal in last year on 07th June 2021.

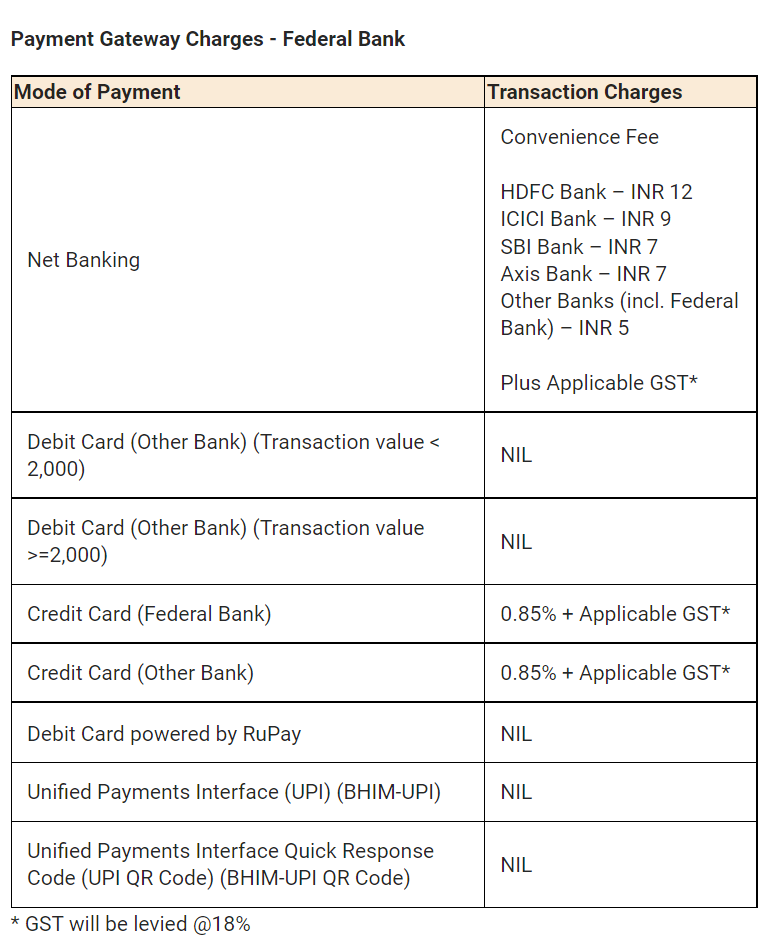

Now, the income tax e-filing website enables the E-pay tax service with increased number of payment option adding RTGS/NEFT and Payment Gateway. Under payment Gateway, wide range of options to the taxpayer are available including Net Banking, Debit Card, Credit Card and UPI. However transaction charges will be applicable under this method, the details of which is as follows:

{Pro Tip: Income Tax Return Filing}

Currently, this additional options are available on Income Tax portal only. Payment through NSDL can also be made by choosing only these old two options i.e Net banking and Debit Card. {Read More: When can I expect my ITR Refund?}

The payment can be made by two ways on Income tax portal

- Without login: you need to select the E-pay tab and enter your PAN no and OTP for the payment

- After login directly select the e-pay tax tab without login

How to pay Tax using UPI method?

The detailed procedure of how to do payments through UPI Methods on Income Tax Portal can be seen through the video attached below.

For any queries or more detailed information, Kindly contact us on +91 982044 4477 or write us on taxzona@gmail.com we will definitely help you with your queries or inquires.