Previously, there were no full proof mechanism with the Income Tax Department to cross verify each and every claim under 80G taken by the donor as deduction in their Income tax return. Not every donation received by trust/Research Institution were checked by the Department. With the Introduction of mandatory Filing of Form 10BD and Form 10BE, genuineness of the 80G deduction and Transparency of Donation received by the Institution can be examined. CBDT issued a notification no. 19/2021 dated 26th March 2021 that is applicable from financial Year 2021-22.

In this article we’ll discuss about this forms Requirement, Content of the Form, Due dates and Steps to file this Form online.

Form 10BD & Form 10BE Requirement

As per CBDT issued a notification no. 19/2021 dated 26th March 2021,

“Statement of particulars required to be furnished by any research association, university, college or other institution or company or fund (hereinafter referred to as reporting person) under clause (viii) of sub-section (5)of section 80G or under clause (i) to sub-section (1A) of section 35 shall be furnished in respect of each financial year, beginning with the financial year 2021-2022, in Form No. 10BD and shall be verified in the manner indicated therein.”

Charitable Institutions which are approved under 80G Certificate or specific Research Institution approved under section 35, which receive Donations are required to Furnish This Form with effect from FY 2021-22. After successful submission, the Charitable Institution can download and give the certificate of Donation in form 10BE to the Donor. Unless the Particulars of the donor is not filled and valid certificate is not issued to Donor, they are not eligible to claim the deduction under 80G in Their Returns.

Content of the Form 10BD & Form 10BE:

Under Form 10BD, Charitable Institution has to report the Total Donation received during the Financial year with the particulars of each donor’s Details such as PAN, Name, Address, Purpose of Donation and mode of Donation. Experts has a view that the total amount of Donation booked and declared in the Income and statement accounts must tally with the total figures.

Following Details of the donors and their donation is to be filled as per the CBDT Notification No51/2022 dated 9th May 2022.

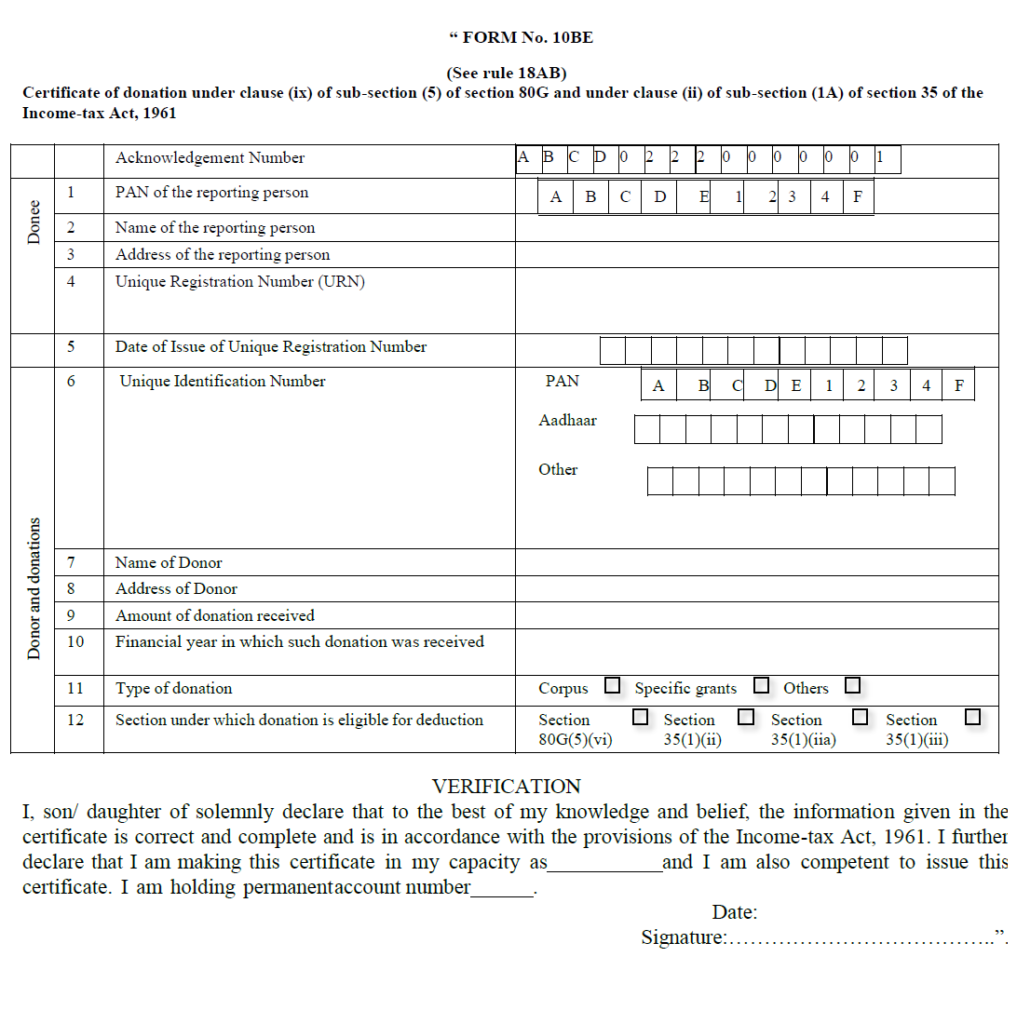

After Successful submission, Portal will generate the Form 10BE which is nothing but a certificate of Donation which should be awarded to the Donor by the Charitable Institution. This will come with a unique Acknowledgement Number as will be a valid proof to claim deduction under section 80G for the Donor.

Following are the particulars of the Form 10BE as per the CBDT Notification No51/2022 dated 9th May 2022.

Due Date to File Form 10BD & Form 10BE

As per the Rule-18AB, Income-tax Rules Inserted by the Income-tax (Sixth Amendment) Rules, 2021, w.e.f. 1-4-2021.

“(9)Form No. 10BD referred to in sub-rule (1) shall be furnished on or before the 31stMay, immediately following the financial year in which the donation is received.”

The due date for Submission Form 10BE is 31st May 2022 for the Financial Year 2021-22.

Consequence of Late/Non Filing

As explained above, Institutions who fails to File Form 10BD or missed to issue Certificate i.e. Form 10BE on or before 31st May, will have to pay the late fees for the submission.

Late Fees: a late fees of Rs.200 per day will be Levied u/s 234G of the Income Tax Act 1961 for delay in submission. The amount of Late fees will increase with every day of day maximum up to the amount of Donation.

Penalty: under section 271K, It will also attract penalty which shall not be less than Rs.10,000/- and which may extend up to Rs.1,00,000/-